How to Read an Income Statement

This is the first of three topics within the “Financial Statements” section of the Finance 101 for Lawyers series. This section discusses common features of an Income Statement, Balance Sheet, and Statements of Cash Flows, including how to read them. Let’s begin with the Income Statement.

Guiding Principles

An Income Statement is a financial statement designed to show the amount of Revenues, Expenses, and Profits a company has earned over a specific period. Income Statements should always be labelled to identify the period of time represented – whether it is a month, a quarter, or a full year.

An Income Statement is like a documentary movie showing how the company generated its revenues, expenses, and profits (or losses) during a specific period of time.

A Balance Sheet is like a snapshot showing the balances of the company’s accounts at a specific point in time.

The information in an Income Statement is always presented in a certain order. Revenues are always at the top with Expenses presented below. Additionally, the Expenses are grouped and presented with those most closely related to the Revenues (the cost of sales) listed above other Expenses that may be less directly related to sales (Operating Expenses). The Income Statement will then list any Income or Expenses incurred by the company outside of their normal core business operations (Non-operating Income or Expenses). The Income Statement always concludes with a calculation of Net Income.

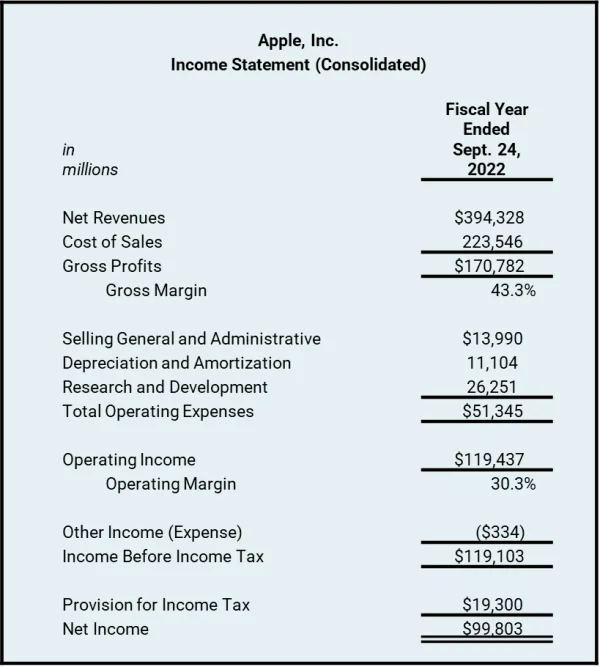

Example: Apple, Inc. Fiscal Year 2022

The Income Statement shown here is a simplified version included as part of Apple’s 2022 Annual Report. Apple refers to this statement as a “Consolidated Statement of Operations.” The word consolidated means this Income Statement includes the Revenues, Expenses, and Profits of Apple’s subsidiaries, not just the parent company Apple, Inc. separately. Also, as part of Apple’s Annual Report, we know this statement complies with the Generally Accepted Accounting Principles (GAAP) and is presented on an Accrual Basis. This statement is identified as representing the Fiscal Year ending September 24, 2022, so we know as a reader this statement includes Apple’s performance for a 12-month period ending on that date.

Common Categories and Terms

- Revenues are the amount of money a business generates by selling products or providing services before subtracting any expenses. As opposed to Gross Revenues, Net Revenues account for allowances for returns, warranty replacements, and certain sales discounts. You may also see these items referred to as Gross Sales or Net Sales. In international financial reporting, you may see revenues identified as Income which should not be confused with Net Income (discussed below).

- Cost of Sales are the expenses directly incurred by the company to make the products and provide the services that are included in the revenue line above. The specific expenses in this category can include raw materials, direct labor costs in the factory, as well as the general costs directly associated with operating the factory. You may also see these costs identified by an equivalent accounting term Cost of Goods Sold or abbreviated as “COGS”.

- Gross Profits are simply the Net Revenues minus the Cost of Sales. This represents the profits of the company before deducting any of the Operating or Overhead expenses discussed below. Gross Margin is a statistic calculated as Gross Profits divided by Net Revenues which is expressed as a percentage. You may see the term Gross Margin and Gross Profit used interchangeably, but we prefer to use the term Gross Margin to refer to the percentage and Gross Profit as the dollar value.

- Operating Expenses include all of the other expenses incurred by the company as part of its operations that are related to the Net Revenues, but not directly related to manufacturing the company’s products or providing the company’s services. Operating Expenses commonly contain multiple categories of expenses including Selling General & Administrative Expenses (SG&A), Depreciation and Amortization, and certain other expenses such as Research and Development Expenses (R&D). Operating Expenses may include expenses that are fixed and not related by the level of sales (i.e., rent of the office space). Operating Expenses may also include certain expenses that vary based on the level of sales (i.e., bonuses and commissions paid to employees).

- Operating Income is Gross Profits minus Operating Expenses. This represents the earnings of the company before it pays interest on any debts or any income taxes. Operating Income is sometimes referred to as Earnings Before Interest and Taxes, or more simply as “EBIT”. Operating Margin is a statistic calculated as Operating Income divided by Net Revenues expressed as a percentage.

- EBITDA is a measure of a company’s earnings that is often cited, but not commonly displayed in a company’s Income Statement. Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is calculable from the information provided on most Income Statements. EBITDA is equal to Operating Income (or EBIT) plus the Depreciation and Amortization identified in the Income Statement (or on the Statement of Cash Flows).

- Other Income (Expense) is usually a category of Income and Expenses that comes after Operating Income. This category can include any number of items that would be considered outside of the normal operations of the business (i.e., gains or losses on the sale of used machines in the factory). This category would also include any interest paid by the company on its bank loans or other debt instruments.

- Income Tax includes provisions for income taxes to local, state, and federal authorities or to foreign governments if there are international operations. This may not represent all of the taxes paid by the company, as there may be real estate taxes or other property taxes that are treated as Operating Expenses.

- Net Income is the result of subtracting all of the relevant expenses from the Net Revenues. This is considered the bottom line “earnings” of the company and what you might see used in things such as price-to-earnings (P/E) ratios. Keep in mind that under Accrual Accounting, this is likely different than the Cash Basis income (or loss) of the firm during the same period.

Summary

An Income Statement is one of the three primary financial statements. An Income Statement shows the Revenues, Expenses, and Profits incurred by a company over a defined period of time. All Income Statements start with Revenues. The next categories will generally be Cost of Sales and Gross Profits and only then followed by Operating Expenses. Most Income Statements end with the company’s Net Income. Keep in mind that Net Income in Accrual Basis accounting is likely different than the cash earnings of the company during the same period.

About the Series

Finance 101 for Lawyers is an ongoing educational series of professional insights intended to explain core accounting, finance, and business valuation concepts to lawyers. The series is designed to provide an overview of these topics to assist lawyers as they counsel their clients on financial issues and present financial information to judges and juries.

Note that the discussion represents an overview of certain financial concepts. As with any summary, certain nuances and complications are not addressed in detail. Appropriate financial analysis should consider the specific facts and circumstances of each situation.

About the Author

Brian Dies, CFA, ASA is a Principal at Archway Research and is an expert in the financial analysis of complex transactions, business valuations, and damages in commercial disputes. Mr. Dies holds the Chartered Financial Analyst designation and is also an Accredited Senior Appraiser in the Business Valuation discipline with a specialty designation in Intangible Asset Valuation. Mr. Dies has also spent time as an Instructor at the Harvard University Extension School teaching Business Valuation at the graduate level.