How to Read a Balance Sheet

This is the second topic within the three-part “Financial Statements” section of the Finance 101 for Lawyers series. This topic discusses common features of a Balance Sheet. Other topics in this section cover the Income Statement and Statement of Cash Flows.

Guiding Principles

A Balance Sheet is a financial statement designed to show the value of the Assets, Liabilities and Equity of a company at a specific date.

- Assets are the things a company owns and can include tangible property like inventory or factories, amounts owed to the company like accounts receivable, or sometimes intangible assets such as purchased intellectual property or acquired goodwill.

- Liabilities are the amounts the company owes someone else and can include amounts owed to vendors, employees, the government, or its lenders.

- Equity (sometimes referred to as Shareholder’s Equity or Owner’s Equity) includes the amount of money raised when the company issued equity, the company’s cumulative Retained Earnings, and potentially additional amounts related to Other Comprehensive Income.

Balance Sheets represent the accounting value of those items at a specific date. Balance Sheets should always be labelled to identify the “as of” date for the information presented.

A Balance Sheet is like a snapshot showing the balances of the company’s accounts at a specific point in time.

An Income Statement is like a documentary movie showing how the company generated its revenues, expenses, and profits (or losses) during a specific period of time.

This brings us to one of the most hard and fast rules of accounting: On a Balance Sheet, the total value of the Assets must always equal the value of the total Liabilities plus the total Equity.

It is very important to note that the value displayed on the Balance Sheet (known as “Book Value”) is most likely not the same as current market value. The information on Balance Sheets is often presented at historical cost, not current market value.

For example, a factory bought 15 years ago may be reported as a $10M Asset on its books, but it might have a current value of $20M if the factory were sold today. The company does not get to increase the value of the Asset it bought for $10M to the current market value on its Balance Sheet. However, the opposite is not true. If the company bought an Asset for $5M and it has declined in value to $1M, there are situations where the value of that asset is determined to be impaired and gets “written down” to the lower, current market value.

In general, once acquired, the value of an Asset cannot increase on the Balance Sheet - it either stays at its historical cost or decreases if it meets the accounting standard for an impairment. There are accounting tests to determine whether a write down or an impairment is necessary. The principle of displaying things at book value or an impaired value is sometimes referred to as “the lower of cost or market.”

Example: Apple, Inc. Fiscal Year 2022

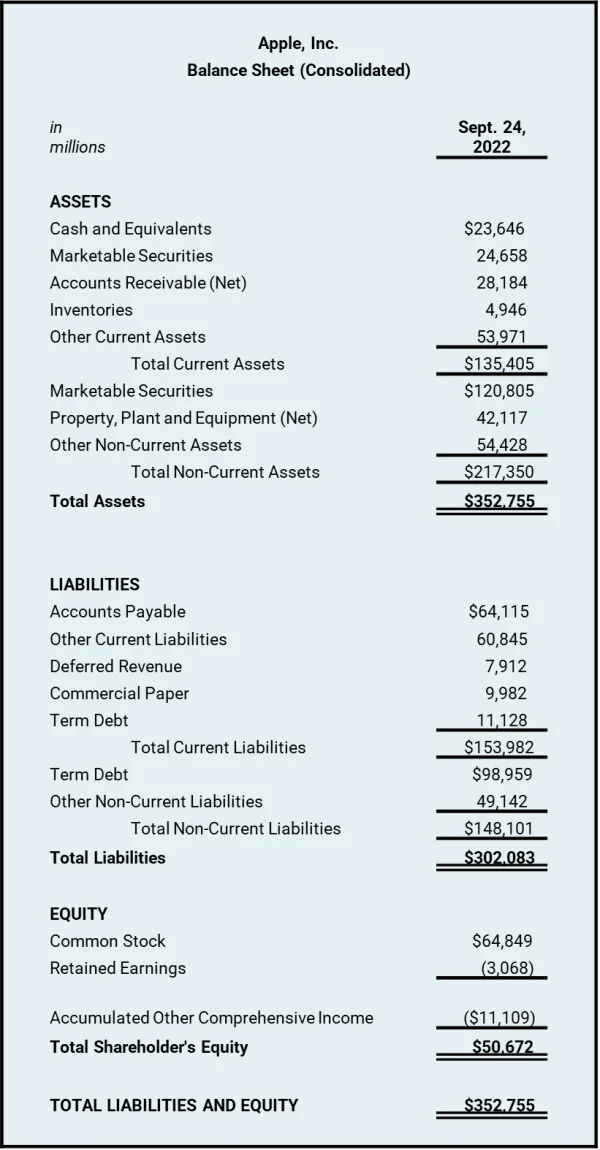

The Balance Sheet shown here is a simplified version included as part of Apple’s 2022 Annual Report. Apple refers to this statement as a “Consolidated Balance Sheet.” The word consolidated means this Balance Sheet includes the Assets, Liabilities and Equity of Apple’s subsidiaries, not just the parent company, Apple, Inc., separately. Also, as part of Apple’s Annual Report, we know this statement complies with the Generally Accepted Accounting Principles (GAAP) and is presented on an Accrual Basis. This statement is identified as being as of the last date of Apple’s Fiscal Year – September 24, 2022.

Common Categories and Terms

The order in which things are displayed on a Balance Sheet follows a couple of guiding principles. At a high level, Assets are always listed first (or sometimes on the left). Liabilities and Equity are listed below the Assets (or sometimes to the right).

On a more detailed level, the specific categories of Assets and Liabilities are also displayed in a general order. For example, the first Asset listed is always Cash. The Assets are generally displayed in an order related to the amount of time it would take to turn that Asset into cash as part of the normal business operations.

Assets

The term “Current Assets” is applied to the first category of Assets listed and includes Assets that are expected to be turned into cash within a year. This typically includes:

- Cash, Cash Equivalents, and sometimes Restricted Cash.

- Accounts Receivable (Net) is the cumulative amount of invoices sent to customers for products or services awaiting payment. A/R is often presented as a “Net” amount – meaning the total after subtracting some amount for a portion of customers expected to not pay in full.

- Inventory is the cumulative value of the firm’s inventory including raw materials, work in process and finished goods inventory. This is presented at cost and not the value at which the company will hopefully sell the finished product.

The rest of the Assets are considered “Non-Current Assets.” The most common is Property, Plant, and Equipment (PP&E) - sometimes also referred to as Fixed Assets. This represents the acquisition cost of the buildings, machinery, and equipment of the company. PP&E is typically expressed after subtracting depreciation expenses (net of depreciation). Again, this is acquisition cost less depreciation and may not reflect the current market value of the buildings, equipment, or fixtures.

Certain categories might be listed both in Current and Non-Current Assets. In the Apple example, the Marketable Securities expected to be converted to cash within one year are listed as a Current Asset, and the Marketable Securities not expected to be converted to cash within one year are listed as Non-Current Assets.

Liabilities

Similarly, “Current Liabilities” are the first category of Liabilities listed and include Liabilities that are expected to generate a cash payment within a year. This typically includes:

- Accounts Payable represents the amount owed by the company to vendors and suppliers for goods or services already received by the company.

- Deferred Revenue is an accounting term representing amounts paid by customers before the product or service is rendered by the company and can be recognized as Revenue. An example is paying for an annual subscription to a monthly magazine up front. The company records the amount in Deferred Revenue and decreases that amount every month as they send the monthly magazine to the subscriber and recognize the Revenues. Until they have sent all twelve months of the annual subscription, the company has a liability to send future issues that have already been paid for with the annual up-front payment.

Liabilities associated with Debt will often show up in both Current and Non-Current Liabilities. The portion of the Debt principal that is repayable within a year is considered a Current Liability. The portion of the Debt principal that is payable more than a year from the Balance Sheet date is a Non-Current Liability. Note that almost always, the Liability accounts related Debt only include the principal amounts, not the interest that will be owed in the future. These debt instruments can include commercial paper (typically very short term), lines of credit, term debt, bank loans, and notes payable.

Equity

The Equity portion of a Balance Sheet tends to be the most challenging for many non-accountants to understand. Although, once broken down, it is not as complicated as it may first appear.

The Equity section usually begins with the Capital Account. For a public company, this account is typically labeled as Common Stock. This may be presented in two or more accounts or as a consolidated account. The components include the “par value” of the stock – often a small amount per share ($0.01 per share or $1.00 per share). The other component of the Common Stock account is what is called the “Additional Paid-in-Capital.” If when the shares of the company were originally issued for $10.00 per share and the par value was $1.00 per share, the Additional Paid-in-Capital would be $9.00 per share. Note that the total amount of the Common Stock account on the Balance Sheet is the amount raised when the shares were issued, not the current market value of the Common Stock.

The next item in the Equity section is called Retained Earnings. This account represents the accumulated Earnings of the company minus the amount paid out in Dividends to the shareholders. For example, if a company had $100 in earnings for the year and paid $25 in dividends, the company Retained Earnings of $75 for the year. This $75 would be added to the Retained Earnings account on the Balance Sheet from the prior year. Note that if the company had a loss for the year or paid out more in dividends than earned in a year, Retained Earnings for the year could be negative. In fact, most start-ups have a negative cumulative Retained Earnings until the company matures and becomes profitable.

There are sometimes additional accounts related to Other Comprehensive Income listed in the Equity section as well. Certain items impact Earnings, but are not included in the company’s Net Income on its Income Statement. This might include gains or losses on foreign currency transactions and gains or losses on minority ownership interests in other certain partially owned subsidiaries. Since Retained Earnings is Net Income minus Dividends, there needs to be a way in the Equity section to record the items related to Other Comprehensive Income in order to accurately reflect the earnings of the firm.

Summary

Simply, the Balance Sheet is a snapshot of the Assets, Liabilities and Equity of the company on a specific date. There are three fundamentals to remember when reading a Balance Sheet:

- Total Assets must equal Liabilities plus Equity (no exceptions).

- The values recorded on the Balance Sheet are typically presented at historical cost – not current market value, (unless there has been a write-down or impairment charge).

- The order the accounts are listed on the Balance Sheet matters – Current Assets and Current Liabilities are listed first and are expected to have a life of less than one year.

About the Series

Finance 101 for Lawyers is an ongoing educational series of professional insights intended to explain core accounting, finance, and business valuation concepts to lawyers. The series is designed to provide an overview of these topics to assist lawyers as they counsel their clients on financial issues and present financial information to judges and juries.

Note that the discussion represents an overview of certain financial concepts. As with any summary, certain nuances and complications are not addressed in detail. Appropriate financial analysis should consider the specific facts and circumstances of each situation.

About the Author

Brian Dies, CFA, ASA is a Principal at Archway Research and is an expert in the financial analysis of complex transactions, business valuations, and damages in commercial disputes. Mr. Dies holds the Chartered Financial Analyst designation and is also an Accredited Senior Appraiser in the Business Valuation discipline with a specialty designation in Intangible Asset Valuation. Mr. Dies has also spent time as an Instructor at the Harvard University Extension School teaching Business Valuation at the graduate level.