What Is the Difference Between Accounting and Finance?

There is no better place to start than with a discussion about the difference between Accounting and Finance. Although they are two distinct disciplines, they are also inherently related. This is the first of two topics within “The Basics” section of the Finance 101 for Lawyers series.

What Is Accounting?

Accounting is a standardized method to track and measure the history of the financial transactions within a business. There are two important points worth emphasizing:

- Accounting is based on standards. Transactions should, in theory, be recorded and reported the same way by different accountants at different companies. This standardization allows outsiders to reliably interpret and understand the reported financial results.

- Accounting presents historical financial information in an unbiased way as a means of record keeping of historical transactions and facts. It typically describes what has happened over a certain period and where things stand as of a given date. Most often, Accounting is not directly telling us what might happen in the future.

What Is Finance?

Finance is the way professionals use Accounting information to answer questions about a business and to make projections about the business’s possible future. Finance is how we use that Accounting information to answer questions or tell a story. The questions can be almost anything about the past, present, or future of the business in question. For example:

- What is a business or part of a business worth?

- Is a certain project or business a “good” or “bad” investment?

- Why did the business perform unexpectedly well (or poorly) last period?

- What can we expect for the performance of the business in the future?

- How does the company's performance compare to how other companies are doing?

Standards and Historical Context

Current Accounting standards in the U.S. are referred to as Generally Accepted Accounting Principles, or more commonly known as GAAP. These are the standards that govern the reported financial information for publicly traded companies. Many midsize and smaller privately owned companies also issue financial statements that are compliant with GAAP. Additionally, there are international Accounting standards known as the International Financial Reporting Standards, or IFRS. GAAP and IFRS are similar, but not identical. There have been sporadic attempts to harmonize the two into a worldwide standard.

These Modern Accounting standards and practices trace their origins back to the bookkeepers for Italian merchants as early as the 13th century. Historians point to these Venetian merchants as the original source of Double Entry Bookkeeping. Double Entry Bookkeeping is the principle of Modern Accounting that every transaction impacts at least two “accounts” in the Accounting records. For example, if a company buys raw materials, the raw material inventory account goes up and the cash account balance goes down. Making the transaction in two different accounts allows the aggregate of all the accounts to remain in balance (hence the phrase “balancing the books”). This concept is one of the foundational principles of what we now know as Modern Accounting.

Some say these concepts are actually even older and can be traced back centuries earlier to the Middle East and India. Nevertheless, Accounting standards and methods do change over time. Just as our language evolves and new words and structures are added to the common vocabulary, Accounting standards evolve to account for new developments (i.e., intellectual property and other intangible assets, increasingly complex debt and equity instruments, multinational corporations, etc.).

What is typically considered Modern Finance is much newer. Many of the core concepts of portfolio theory and equity valuation were developed in the mid-1900s. For example, up through the industrial revolution the value of a business was simply considered to be the value of its assets minus its liabilities. It was not until the 1920s that a business’s value started to be tied to its projected future cash flows and profits. Of note, modern business valuation techniques can, in part, be traced to the methods used to determine the compensation paid by the U.S. Government to breweries that were closed due to Prohibition.

Summary

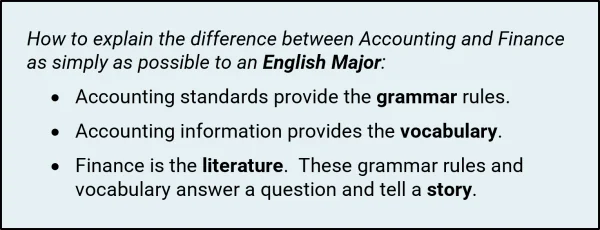

Accounting standards can be thought of like grammar rules. Although they change over time, the core Accounting rules can be traced back centuries. Accounting information, meaning the records and the numbers, are more analogous to the specific vocabulary used to describe the operations and financial position of a specific company or industry.

Finance is a way to use the Accounting standards and the Accounting information to tell a story and answer questions about a company. Most of the tools of Modern Finance were developed in the mid-1900s, or even more recently.

About the Series

Finance 101 for Lawyers is an ongoing educational series of professional insights intended to explain core accounting, finance, and business valuation concepts to lawyers. The series is designed to provide an overview of these topics to assist lawyers as they counsel their clients on financial issues and present financial information to judges and juries.

Note that the discussion represents an overview of certain financial concepts. As with any summary, certain nuances and complications are not addressed in detail. Appropriate financial analysis should consider the specific facts and circumstances of each situation.

About the Author

Brian Dies, CFA, ASA is a Principal at Archway Research and is an expert in the financial analysis of complex transactions, business valuations, and damages in commercial disputes. Mr. Dies holds the Chartered Financial Analyst designation and is also an Accredited Senior Appraiser in the Business Valuation discipline with a specialty designation in Intangible Asset Valuation. Mr. Dies has also spent time as an Instructor at the Harvard University Extension School teaching Business Valuation at the graduate level.